Why Bank On Burque?

Our Mission:

- To connect individuals and families to safe and affordable checking accounts available in the Albuquerque community.

- To initiate and support a Bank On Burque Coalition. Bank On coalitions are locally-led partnerships between local public officials; city,state, and federal government agencies; financial institutions; and community organizations that work together to expand banking access in their communities.

Our Beginning..... Bank On Burque: A Municipal Blueprint for Financial Empowerment in Albuquerque

Mayor Tim Keller announced the Bank On Burque Blueprint for Financial Empowerment in June 2019 following a six-month stakeholder engagement process. The blueprint focuses on what the City of Albuquerque can do to promote access to safe, affordable banking and financial education among City employees and community members.

The Bank On Burque Blueprint Financial Empowerment touches on four keys of financial empowerment emphasized by Cities for Financial Empowerment Fund (CFE), who provided funding and technical assistance to the City for the blueprint process: asset building; banking access; consumer financial protection; and financial education and counseling.

Quick Facts:

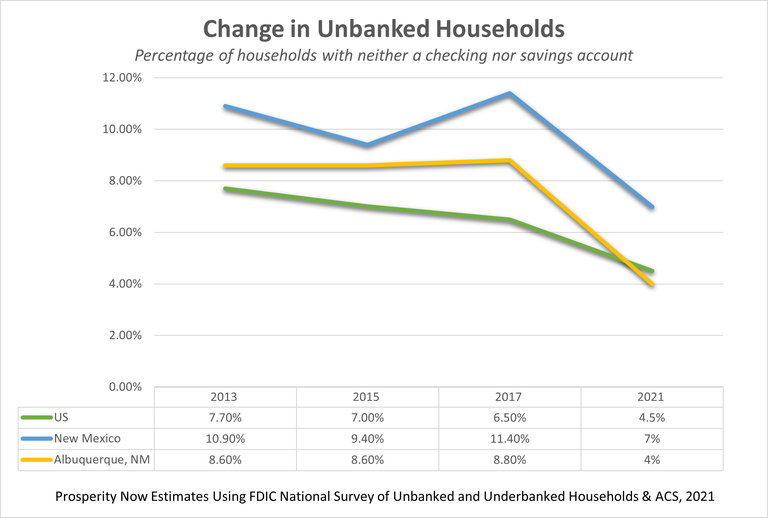

- Close to 4.5% of U.S. households (approximately 5.9 million adults) are “unbanked,” without a checking nor savings account.

- Almost 14.1% of U.S. households (approximately 18.7 million adults) are underbanked, meaning they have an account but use alternative, costly financial services for basic transaction and credit needs.

- Nearly 29.2% of unbanked and 38.1% of underbanked households earn less than $30,000 per year.

- Nationally, 36% of Black households and 33.4% of Hispanic households are unbanked or underbanked, compared to less than 12% of white households.

When the Bank on Burque initiative began, the percentage of Unbanked Households in Albuquerque exceeded the national average. The positive impact of this initiative has now brought the percentage of Unbanked Households in Albuquerque below the national average.